Customs

The efficient customs procedures that AM Cargo offer, make that that deadlines in transport process of export operation to be accomplished on time. Apart of saving time, the customers can have economic benefits and achieve higher tax security.

CUSTOM CLEARANCE

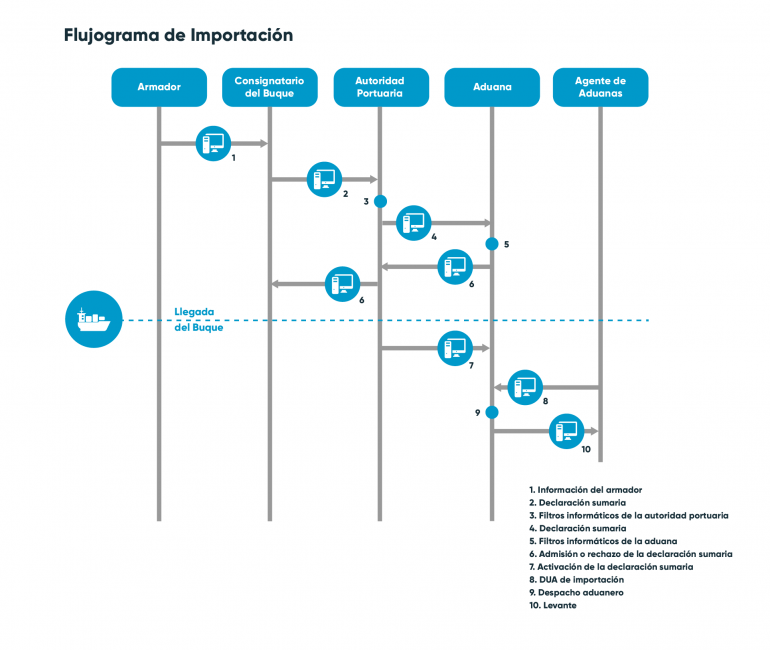

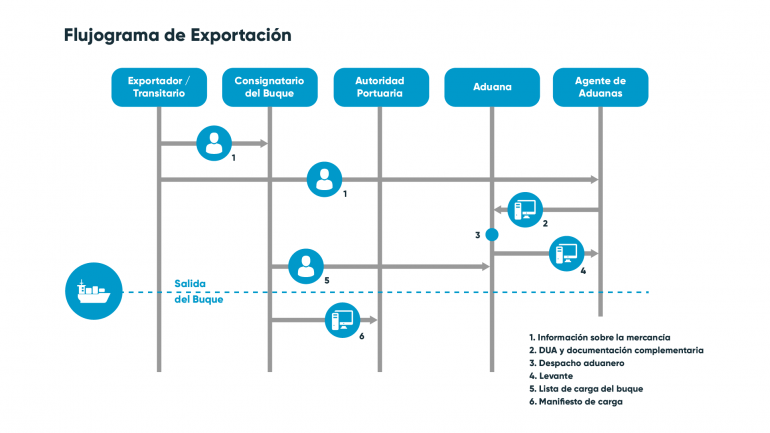

Custom clearance process – EDI (Export, Import and Transit)

Custom clearance is the formality which need to be done for entering or outing of merchandises on a country territory.

- Export declaration: Must be done once a merchandise is gate in (Port, Airport, free port zone, customs warehouse) and before being shipped on a vessel or a plane. The documents for this procedure are the commercial invoice and packing list.

- Import declaration: Must be done when a merchandise arrives to its final destination once is unloaded from the vessel or plane in order to take out from customs precinct. The documents for this procedure are the commercial invoice, packing list and BL (Bill of Lading).

EDI Process accelerate the formality due to electronic sending of information and documents.

Special certificates process (sanitary, phytosanitary, pharmacy, SOIVRE certificates)

It offers solutions for sectors like food or pharmacy sector. These products require specific documents and customs process is longer and more complex.

Certificates of origin

The certificate of origin proves the origin of the goods complying with commercial or custom requirements.

The origin of the goods is important for a correct custom declaration or commercial purpose once the goods enter in a country, on a specific custom territory.

AM Cargo take care of issuing and legalizing the certificate on exporter’s account. With this document the importers can ask for discount of some fiscal taxes in their country.

Fiscal representation and EORI registration

Through this service, non-residents companies allow their consultant with Spanish ID to make sales and purchases operations. These companies should also obtain an EORI number, associated to the Spanish ID, in order to issue on their own name, import and export declarations.

The EORI (Economic operator registration and identification number) is a unique number in EU. The customs authority is the one assigning this number in each European Union state to any company, person or entity carrying out activities related with customs.

Bonded Warehouse (DA)

The function of this service is to allow importers to store goods which are not from UE, for an undefined long term. This way they don’t have to pay import Vat tax, either duty taxes until the goods don’t leave the warehouse.

Fiscal depot (DDA)

Fiscal depot authorized by Spanish authorities, that allows the import of goods on UE territory without paying in advance the Vat tax , neither when goods are purchased or received.